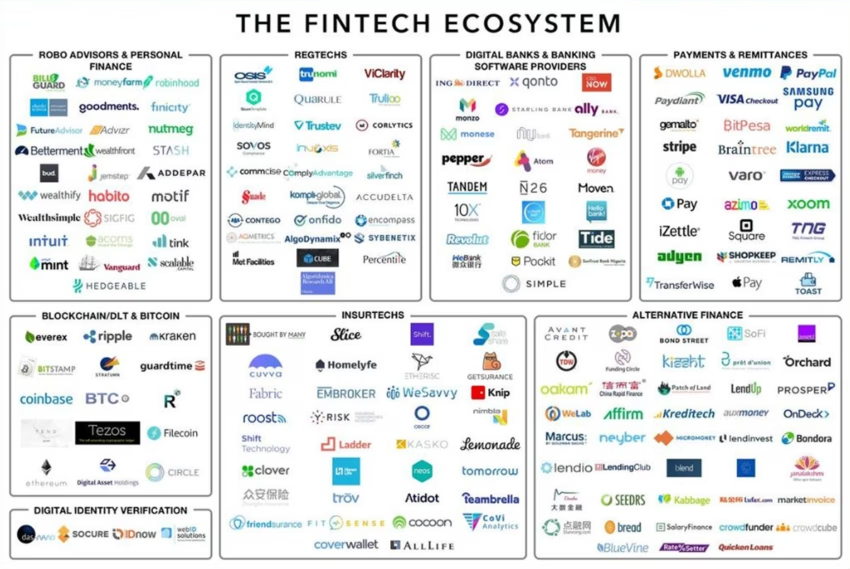

What Are Some Fintech Examples?

In this article, I am going to provide some real-life fintech examples. From mobile banking to portfolio management apps and robo-advisors, I will cover the most common use cases of fintech software solutions.

In this article

- 10 Top Fintech Examples

- Transforming complex finance processes in financial institutions

- Frequently Asked Questions on Fintech

What is fintech in simple words? “Fintech” stands for “financial technology”, which uses emerging technology to widen the scope and reach of financial services.

Before we start discussing fintech examples transforming our everyday life, let's take a look at interesting facts and statistics pertaining to the fintech industry.

According to Statista, fintech companies headquartered in the US and China top the ranking of the world’s largest fintech companies by market capitalization. As of May 2025, the two largest companies were payment companies Visa and Mastercard, both headquartered in the US, with market capitalizations of approximately $696.6 billion and $521.8 billion, respectively. Shopify ranked third, and Intuit ranked fourth with a market capitalization of $163 billion.

Get a complimentary discovery call and a free ballpark estimate for your project

Trusted by 100x of startups and companies like

10 Top Fintech Examples

A few prominent fintech examples are as follows:

1. Mobile banking and digital banking: A key one among fintech examples

The banking industry has operated through branches for centuries. While ATMs brought in changes, traditional banking still relies on brick-and-mortar infrastructure. Fintech has changed this via Internet banking and mobile banking.

All over the world, banks now enable customers to access their bank accounts over the Internet. Web and mobile banking allow consumers to conduct plenty of digital financial transactions from their bank accounts. There are also “neobanks” that operate entirely using the digital infrastructure.

Mobile banking capabilities are growing rapidly. Many traditional banks now offer many retail banking services on mobile devices. Observers note that mobile apps have already eclipsed desktop-based online banking for many transactions.

2. Trading in cryptocurrencies: A popular one among fintech examples

Cryptocurrencies might prove to be a key disruption for traditional financial institutions, and their popularity is growing. More and more people now trade in cryptocurrencies like Bitcoin and Ether. Cryptocurrency exchanges play a key part here.

Crypto exchanges are websites or mobile apps that allow crypto traders to trade cryptocurrencies. Traders might trade in one cryptocurrency for another, alternatively, they might trade cryptocurrencies for fiat currencies.

Crypto exchanges use the web and mobile technology to serve their customers. Coinbase, Binance, Kraken, Gemini, Crypto.com, KuCoin, Bitstamp, Bittrex, and eToro are some of the popular crypto exchanges.

3. DeFi (decentralized finance): Fintech companies offering blockchain-based financial services

The traditional financial industry is centralized, however, DeFi (decentralized finance) intends to decentralize the delivery of financial services. DeFi is a fintech innovation based on blockchain.

Most DeFi projects are created on Ethereum, the famous public blockchain network. Entrepreneurs and developers use the Ethereum blockchain platform to create DeFi applications.

DeFi projects use cryptographic tokens for transactions. Therefore, they bypass the constraints that the established financial institutions face.

Stablecoins are examples of DeFi projects. These are cryptographic tokens that maintain stability in their price, which is an advantage in the volatile crypto market. USDC is an example of stablecoins.

Crypto-based lending platforms are other examples of DeFi projects. Aave is an open-source protocol earning interest on deposits and borrowing assets.

Hire expert developers for your next project

1,200 top developers

us since 2016

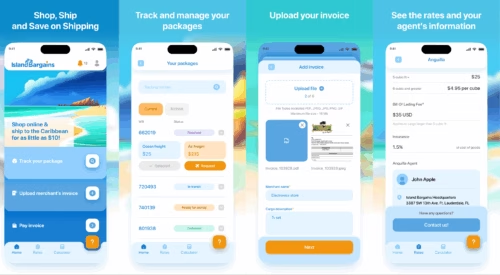

4. Mobile payment apps and mobile wallets

Mobile payments are great examples of fintech. They made it easier to transfer money than the traditional payment methods. These apps make shopping and bill payment easier too.

The advances made in mobile technology made the growth of mobile payment apps and mobile wallets possible. Some of the best apps in this category are as follows:

- Apple Pay;

- Google Pay;

- Samsung Pay;

- PayPal;

- Venmo;

- Alipay;

- Wise, which was earlier known as TransferWise.

5. Crowdfunding platforms: Transforming lending with the help of financial technology

Many entrepreneurs have found it hard to get loans from established financial institutions. The complex financial processes make things hard for borrowers.

Fintech has brought in crowdfunding platforms and peer-to-peer lending platforms to change this. These platforms make it easier for borrowers to get loans. Examples are platforms like LendingClub and GoFundMe, which use advanced technologies to streamline their business operations.

6. Fintech in the insurance industry

“Insurtech” (insurance technology) is making an impact in the insurance industry. It’s a form of fintech, furthermore, it includes regulatory technology. Traditional insurance companies face plenty of challenges. Complex regulations, high customer acquisition costs, and the high cost of relationship management are examples of these challenges.

Insurtech intends to simplify and transform many processes in the insurance industry. It also offers tailored insurance services to different market segments. Insurtech can transform insurance processes like claims processing and fraud detection. Ladder, Wefox, Spot, and Zesty are a few Insurtech companies.

7. Budgeting and portfolio management apps

Fintech has made important differences in the world of managing personal finance. Consumers can use budgeting and portfolio management apps to create their budgets. They can use these personal finance apps to record their financial transactions.

You can connect your personal finance app with your savings account. The app can identify trends from your bank data and help you to manage expenses better. Personal finance apps can provide investment advice, furthermore, they can help you to manage your portfolio. Personal Capital, Credit Karma, and YNAB are examples of such apps.

8. Robo-advisors in the asset management sector

Fintech can automate investment advice, and we call such platforms “robo-advisors”. These digital platforms use algorithms to extract insights from data. They provide investment advice tailored to individual investors. Wealthfront is an example.

9. Stock trading apps

Fintech has made important inroads in online investment management services, and stock trading apps illustrate that. Startups as well as established wealth management companies have made a mark in this space. Stock trading apps use the web and mobile technologies to make investment management and stock trading easier for users.

Charles Schwab, Robinhood, thinkorswim, Ally, SoFi Active Invest, Wealthsimple, Vanguard, and Fidelity are examples of such apps. Some of the stock trading apps might offer other consumer-oriented services. E.g., Ally offers banking services. To take another example, Vanguard offers various types of transfers.

Hire expert developers for your next project

10. Algorithmic trading with the help of artificial intelligence and machine learning

In the investment world and stock market, algorithmic trading is becoming increasingly more important. Algorithm trading is automated trading powered by computers. Observers state that over 90% of the orders in the stock market are computer-driven.

Fintech companies have gone further forward, and they are enhancing algorithmic trading with the power of artificial intelligence and machine learning. AI and ML are making algorithmic trading faster and more accurate.

The finance industry generates plenty of unstructured data. ML algorithms and analytics are extracting insights from this data to make algorithmic trading more efficient. 8topuz, Kryll, and AI Autotrade are examples of companies in this space.

11. Transforming complex finance processes in financial institutions

Traditional banks, credit card companies, and other financial institutions have plenty of complex and manpower-intensive business operations. Credit reporting and implementing anti-money laundering (AML) mechanisms are just two examples.

Fintech goes a long way to transform these processes. Consider the case of AML. Experts believe that fintech-powered anti-money laundering solutions can greatly augment the efforts of banks. Another example is Credit Karma, which provides free credit scores and credit reports.

Conclusion

Planning to offer superior fintech services with the help of advanced technology? Contact DevTeam.Space to hire competent developers.

DevTeam.Space is an innovative American software development company with over 99% project success rate. DevTeam.Space builds reliable and scalable custom software applications,including mobile and web apps, and websites for the fintech industry.

DevTeam.Space supports its clients with business analysts and dedicated tech account managers who monitor tech innovations and new developments and help our clients design, architect, and develop applications that will be relevant and easily upgradeable in the years to come.

Frequently Asked Questions on Fintech

The choice of software technology depends on the use case. Fintech startups might use the web and mobile technologies, artificial intelligence capabilities like machine learning, analytics, business intelligence, big data, cloud computing, and blockchain.

Data security is very important in fintech. After all, fintech companies work in the banking and financial services industry. This industry is subject to a stringent regulatory regime. The compliance processes are highly involved, and data security is a key part of them.

Cloud services are very important in fintech. Many tech companies in the fintech space used cloud computing to their advantage to usher in key innovations. However, fintech companies need to secure financial data. Therefore, they need to focus on data security when using cloud computing.