What is the Future of Fintech?

In this article, I am going to discuss what the future holds for the fintech industry and suggest my answers to questions like "What's the next big thing in fintech?" or "Is fintech going to grow?".

The future of fintech: 12 trends

“FinTech” (financial technology) has significantly expanded the reach of banking and financial services, furthermore, it has brought-in consumer-focused innovations. The future of fintech will witness the following key trends:

1. The spread of “as-a-service” business models in fintech

We all know about the cloud computing delivery models like “Infrastructure-as-a-Service” (IaaS), “Platform-as-a-Service” (PaaS), and “Software-as-a-Service” (SaaS). In essence, these delivery models point to the growing demand for specialization. A small business looking for a CRM SaaS is looking for CRM products and services. It wants the SaaS vendor to manage product updates and other aspects of the product.

The focus on specialization is quickly spreading into the fintech services landscape. E.g., specialized suites of products and services will be offered as “banking-as-a-service”. Traditional financial services providers and banks can have a great advantage here due to their hardened business capabilities. We might witness traditional financial institutions launching “as-a-service” fintech solutions.

2. The growth of hybrid cloud in fintech businesses

Financial companies have vast repositories of confidential data. They also run computing workloads that require high security. Naturally, the financial services industry is a highly-regulated one.

Get a complimentary discovery call and a free ballpark estimate for your project

Trusted by 100x of startups and companies like

Cloud computing and cloud services have played a key part in the growth of fintech. However, the fintech industry can’t rely entirely on the public cloud. They might be able to run workloads with lower security requirements on a public cloud. However, they need to use a private cloud to execute workloads with the high-security requirement.

Also, customers of fintech companies might use open banking technologies to share data across different fintech apps. Fintech companies need to account for it. They need to use a hybrid cloud to balance scalability and security requirements.

3. The growth of mobile banking and cashless transactions in the financial services industry

Digital banking and mobile payments are important constituents of fintech. Their importance will further increase.

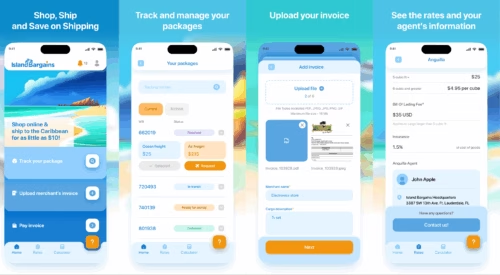

In an era where the Internet and smartphones touch nearly everything in our life, we can hardly overstate the importance of mobile apps for the fintech industry such as digital banking, mobile banking, and mobile payments. The convenience they offer is significant.

If anything, the COVID-19 pandemic made them even more important. Big tech companies see the importance of mobile banking and mobile payments too, and the success of Google Pay is the proof. A Globe Newswire report estimates that the global digital banking market will grow to $1,702.4 billion by 2026. Experts predict massive growth in the mobile payments space too.

4. The introduction of “Central Bank Digital Currencies” (CBDCs)

The introduction of CBDCs will make blockchain very important in the banking industry.

Cryptocurrencies are around for more than a decade now. However, they aren’t quite part of the traditional banking services. These digital currencies work outside the control of central banks and governments. Consumers might use their traditional banking accounts to buy cryptocurrencies, however, banks can’t really control cryptocurrency transactions.

That will change in the future as more and more countries are warming up to the idea of CBDC (central bank digital currency). CBDCs will be digital forms of the currency of a country. Central banks of the respective countries will launch them. CBDCs will be built using blockchain technology, however, the central bank of the respective country will control these digital assets.

5. Wealth management and asset management will witness a growing use of fintech

Wealth management and asset management apps have democratized personal financial management. They are already very important constituents of fintech, and their importance will grow further.

Consumers that wanted to invest in the stock market had to rely entirely on brokerage firms and their paperwork-intensive processes. Individuals that wanted to practice financial discipline had to rely on their personal notes or Microsoft Excel. Neither was easy.

Fintech apps like Robinhood have made stock market investment easier. They have lowered the entry barrier. Robinhood allows cryptocurrency trading too. There are also budgeting and investment apps like Stash, which make personal financial management easier. Customers will increasingly value such apps in the future.

6. Fraud prevention and cybersecurity teams will converge in the modern financial institutions

The banking and finance sector is a “high-value” target for fraudsters as well as cybercriminals. Earlier, fraudulent transactions and cyber-attacks were seen as different though. That’s because they indeed were different threats.

Consequently, banking and financial institutions maintained two separate teams for fraud prevention and cybersecurity. These teams worked in silos. They might work together in the case of emergencies, however, that’s not the normal practice.

Hire expert developers for your next project

1,200 top developers

us since 2016

Cybercriminals and fraudsters increasingly take advantage of sophisticated technology. They often work together. Fraudsters often take advantage of information security vulnerabilities in a bank, and technologies like AI play into their hands.

Banks and traditional financial institutions increasingly realize the need to combine their fraud prevention and cybersecurity teams. That’ll provide an institutional framework for systematic collaboration. Fintech companies will then stand a better chance to prevent fraudulent transactions and cyber-attacks.

7. DeFi (decentralized finance) will introduce disruptive business models that might disrupt traditional financial institutions

DeFi (decentralized finance) will solve problems that traditional financial services providers couldn’t solve effectively. This will make DeFi an important part of the future of fintech.

DeFi is a set of financial products and services built using blockchain technology. Most of the DeFi applications are DApps (decentralized applications) that run on the Ethereum blockchain network. DeFi applications drive disruptive business models since they make a central intermediary irrelevant. This improves the efficiency of a broad range of financial products and services.

Lending is an example. Banks and financial institutions need to follow stringent processes to ensure the viability of loans. Due to manpower shortage, they can’t implement these processes in many parts of the world. As a result, many deserving borrowers can’t get loans in the traditional financial services industry.

DeFi crypto lending platforms like Maker, Aave, and Compound are solving this problem using technological advancements. They use blockchain technology platforms to bring lenders and borrowers together. These platforms use smart contracts to eliminate the need for establishing explicit trust. Lenders and borrowers execute transactions without a central intermediary, and lenders earn interests.

8. Prominence of “Financial Advisors” powered by Artificial Intelligence (AI) and Machine Learning (ML)

Robo-advisors will play an increasingly important role in the future. They will assist many more investors in navigating the complexities of the financial market.

Robo-advisors use AI and its subsets like machine learning (ML) and natural language processing (NLP). They will help both retail and institutional investors manage their portfolios better.

Robo-advisors will be an important part of fintech in the future. An Allied Market Research report estimates the global market for robo-advisors to grow from $7.9 billion in 2022 to $129.25 billion by 2032.

9. The need to focus on customer relationships and customer experience

Customer relationship management and customer support provided by fintech companies have the potential to change the day-to-day lives of consumers. These aspects have a make-or-break impact on fintech, therefore, financial executives will increasingly focus on them.

Traditional banks with their brick-and-mortar operating model earlier had the opportunity to provide a personal touch in customer relationship management. How many of them took the opportunity is a different matter though! With the explosive growth in customer base, traditional banks could no longer provide that personal touch.

Digital banking can provide for better customer support. Fintech companies can use AI-powered chatbots to provide prompt and useful customer support. However, they need to invest in “training” these chatbots more effectively. This will help chatbots answer simple-to-medium-complexity queries. Experienced professionals can then focus on complex problems, which help to improve customer experience.

10. Cheaper computing resources and more powerful computing infrastructure will act as major drivers for innovations in fintech

Computing resources and infrastructure are becoming cheaper. As experts say, cloud computing has brought us from scarcity to abundance as far as computing resources are concerned.

Hire expert developers for your next project

Large-scale innovations in wireless technology are making their mark too. 5G will offer a much faster Internet connection. It will reduce latency, and 5G will offer higher bandwidth.

Fintech innovation could use cheaper and faster computing resources. Consider the example of Deep Learning, a subset of machine learning. Creating an effective deep learning model requires significant computing resources. Improved hardware and software capabilities will help fintech and all businesses to harness new technology better.

11. There will be more instances of financial services being embedded into other products and services

Embedded finance will be an important constituent of fintech in the future. We will see deeper integration of financial services into non-financial services.

Apple Card already presents an indication of what the future looks like. Embedded fintech will experience massive growth. A 2021 report from Payments.com estimates that embedded finance will have a $7 trillion market in 10 years from the time of reporting.

In the United States, the revenue generated by embedded finance was estimated at $22.5 billion back in 2020 and was projected to reach over $230 billion by 2025.

12. Sustainability will be a top priority for both fintech startups and enterprises

Sustainability is a significant priority in the global economy. Governments, businesses, and non-governmental organizations are trying to mitigate the risks brought by climate change. Over the last decade, more and more businesses are looking at sustainability as an opportunity. They are using new technologies to meet sustainability objectives.

Fintech businesses aren’t exceptions. Experts point out how fintech can support the “Sustainable Development Goals” (SDGs) of the United Nations. Fintech businesses empower people by providing greater access to banking and financial services. This improves financial inclusion. Empowered people can contribute significantly more to SDGs.

Conclusion

We described the future of fintech. If you are planning to develop and launch fintech solutions, contact DevTeam.Space to hire competent fintech app developers.

DevTeam.Space is an innovative American software development company with over 99% project success rate. DevTeam.Space builds reliable and scalable custom software applications, including for the fintech industry.

DevTeam.Space supports its clients with business analysts and dedicated tech account managers who monitor tech innovations and new developments and help our clients design, architect, and develop applications that will be relevant and easily upgradeable in the years to come.

Frequently Asked Questions on fintech

Some of the best fintech companies to invest in are as follows: Visa Inc., MasterCard, Intuit, Cash App, Affirm Holdings, Block (formerly Square Financial Services), PayPal Holdings, Goldman Sachs, Upstart Holdings Inc., Western Union, Klarna, Robinhood, Coinbase, Alphabet, and Stash.

The following are fintech examples: Digital and mobile banking, crypto trading, DeFi (decentralized finance), Mobile wallets and digital payments, crowdfunding platforms, “Insuretech”, budgeting and portfolio management apps, stock trading apps, and algorithmic trading.

The key fintech security challenges are as follows: cloud security loopholes, malware, data breaches, digital identity theft, financing crime using cryptocurrencies, and the high cost of security compliance.

Related FinTech Articles

- Fintech Software Development: How to Build the Right Team?

- What Technologies Contribute to Fintech?

- What are Some Fintech examples?

- Fintech Companies to Invest In

- How to Secure Transaction Code?

- Financial Apps Development: How To Build A Financial Management App

- How to Integrate Artificial Intelligence in Fintech Apps

- How to Launch an ICO Successfully in 2024?

- How To Build A FinTech App